Free Trade Zone in India

Free Trade Zone in India

Explore the benefits of smooth international trade with our Free Trade Zone in India.

Free Trade Zone in India

Explore the benefits of smooth international trade with our Free Trade Zone in India.

Free Trade Zone India

Free Trade Zone India

Free Trade Zone India

Our Free Trade Zone in India provides the advantage of importing and exporting with duty deferment, tax benefits, cost efficiency, and optimized distribution channels. Free Trade Zone in India facilitates re-exporting goods from India without the typical burden of Indian duties and taxes. Additionally, we offer comprehensive services like repacking, relabeling, kitting, palletization, and assembly, all tailored for non-duty-paid goods, ensuring efficient and Duty-Free Warehousing India.

Our Free Trade Zone in India provides the advantage of importing and exporting with duty deferment, tax benefits, cost efficiency, and optimized distribution channels. Free Trade Zone in India facilitates re-exporting goods from India without the typical burden of Indian duties and taxes. Additionally, we offer comprehensive services like repacking, relabeling, kitting, palletization, and assembly, all tailored for non-duty-paid goods, ensuring efficient and Duty-Free Warehousing India.

FEATURES

Indian Free Trade Zone : Tailored Storage and Handling Solutions

Indian Free Trade Zone : Tailored Storage and Handling Solutions

We are your gateway to seamless international trade - tax free warehousing India. Our core services focus on Free Trade Warehousing Zones (FTWZs) in India, strategically located to simplify your import and export operations.

We are your gateway to seamless international trade - tax free warehousing India. Our core services focus on Free Trade Warehousing Zones (FTWZs) in India, strategically located to simplify your import and export operations.

Sensitive Cargo

Preserve goods orientation

for safe transport

Cold Storage

Maintain temperature

sensitive cargo.

Open Yard Storage

Versatile storage

for all needs.

Sensitive Cargo

Preserve goods orientation

for safe transport

Cold Storage

Maintain temperature

sensitive cargo.

Open Yard Storage

Versatile storage

for all needs.

Sensitive Cargo

Preserve goods orientation

for safe transport

Cold Storage

Maintain temperature

sensitive cargo.

Open Yard Storage

Versatile storage

for all needs.

Value added Services

Enhance your supply chain

for competitive advantage.

Tailored solutions

Customized FTWZ solutions

for complex cargo.

Consolidation Hub

Consolidate goods for faster,

cost-efficient export.

Value added Services

Enhance your supply chain

for competitive advantage.

Tailored solutions

Customized FTWZ solutions

for complex cargo.

Consolidation Hub

Consolidate goods for faster,

cost-efficient export.

Value added Services

Enhance your supply chain

for competitive advantage.

Tailored solutions

Customized FTWZ solutions

for complex cargo.

Consolidation Hub

Consolidate goods for faster,

cost-efficient export.

Inventory Management

Optimize stock tracking

with real-time visibility.

International Infrastructure

State-of-the-art infrastructure

with numerous benefits.

Custom Clearance

Streamline imports & exports

with expert clearance.

Inventory Management

Optimize stock tracking

with real-time visibility.

International Infrastructure

State-of-the-art infrastructure

with numerous benefits.

Custom Clearance

Streamline imports & exports

with expert clearance.

Inventory Management

Optimize stock tracking

with real-time visibility.

International Infrastructure

State-of-the-art infrastructure

with numerous benefits.

Custom Clearance

Streamline imports & exports

with expert clearance.

Amenities

Warehouse Amenities at Free Trade Zone India

Warehouse Amenities at Free Trade Zone India

Facility

Equipments

Cold Storage

Warehouse Facility

We have two Warehouse Facilities with 6-foot elevation and G + 4 racking, ensuring ample cargo space. With Air-powered dock levellers ensure seamless loading and unloading, maximizing efficiency and minimizing downtime.

Facility

Equipments

Cold Storage

Warehouse Facility

We have two Warehouse Facilities with 6-foot elevation and G + 4 racking, ensuring ample cargo space. With Air-powered dock levellers ensure seamless loading and unloading, maximizing efficiency and minimizing downtime.

Facility

Equipments

Cold Storage

Warehouse Facility

We have two Warehouse Facilities with 6-foot elevation and G + 4 racking, ensuring ample cargo space. With Air-powered dock levellers ensure seamless loading and unloading, maximizing efficiency and minimizing downtime.

2

Facilities

2

Facilities

2

Facilities

2000 pallet positions

Racking Space

2000 pallet positions

Racking Space

2000 pallet positions

Racking Space

1 Lakh Sqft

Total Space

1 Lakh Sqft

Total Space

1 Lakh Sqft

Total Space

25000 Sqft

Cold Storage

25000 Sqft

Cold Storage

25000 Sqft

Cold Storage

FTZ OVERVIEW

FTZ OVERVIEW

FTZ OVERVIEW

Maximize Efficiency and Global Reach with Free Trade Zone India

Maximize Efficiency and Global Reach with Free Trade Zone India

Strategic Location

Strategic Location

Benefit from a strategically located Free Trade Zone, providing easy access to major transportation hubs, facilitating the efficient movement of goods.

Customs Benefits

Enjoy reduced customs formalities and duty-free import benefits, contributing to streamlined operations and increased financial flexibility at FTZ India.

Global Connectivity

Global Connectivity

Leverage the Free Trade Zone India strategic positioning to connect your goods to major trade routes, expanding your global reach and market access.

Just In Time

Just In Time

Strategic inventory management to save time and costs. Gain a competitive advantage by enhancing the quality of your services with Free Trade Zone .

Bulk/Sensitive Commodities

Availability of an open or designated area at our Free Trade Zone for convenient storage of bulk and sensitive commodities.

Duty Deferment

Defer duty payment and compliance to the Allied Acts while goods are still in Free Trade Zone. Greatly improves cash flow.

Sectors we serve

Sectors we serve

Sectors we serve

Exceptional Handling Capabilities at FTWZs

At Free Trade Zones (FTWZs), we take immense pride in our unparalleled expertise in managing sensitive cargo with the utmost precision and care.

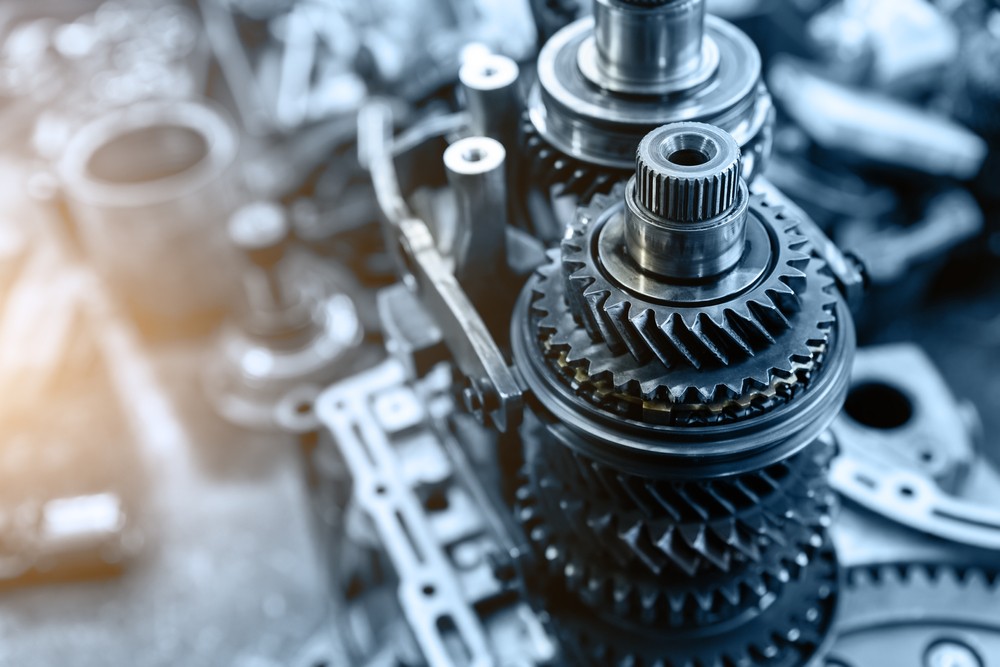

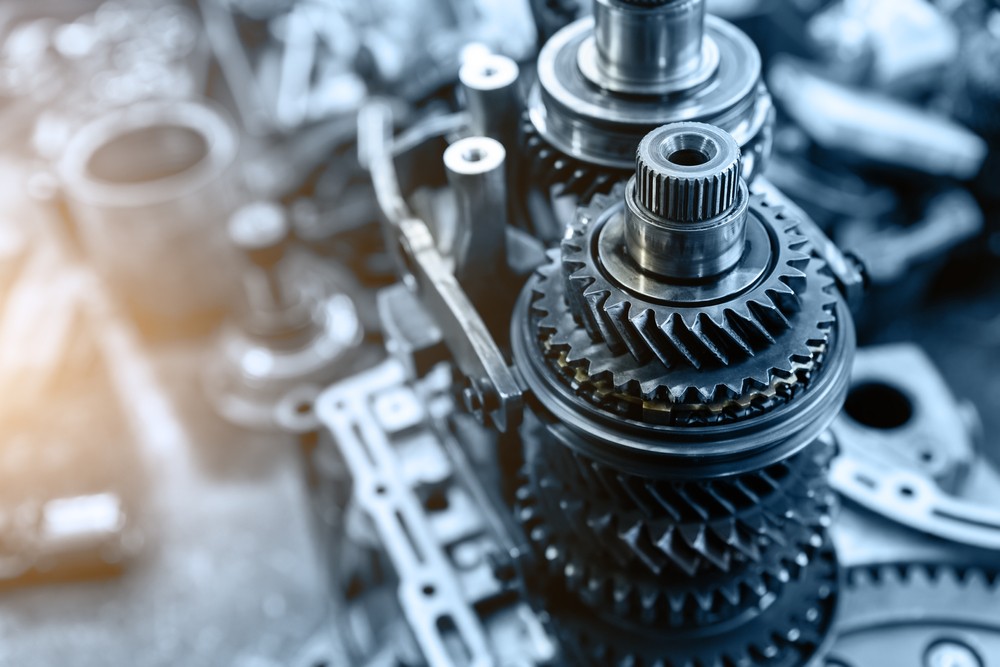

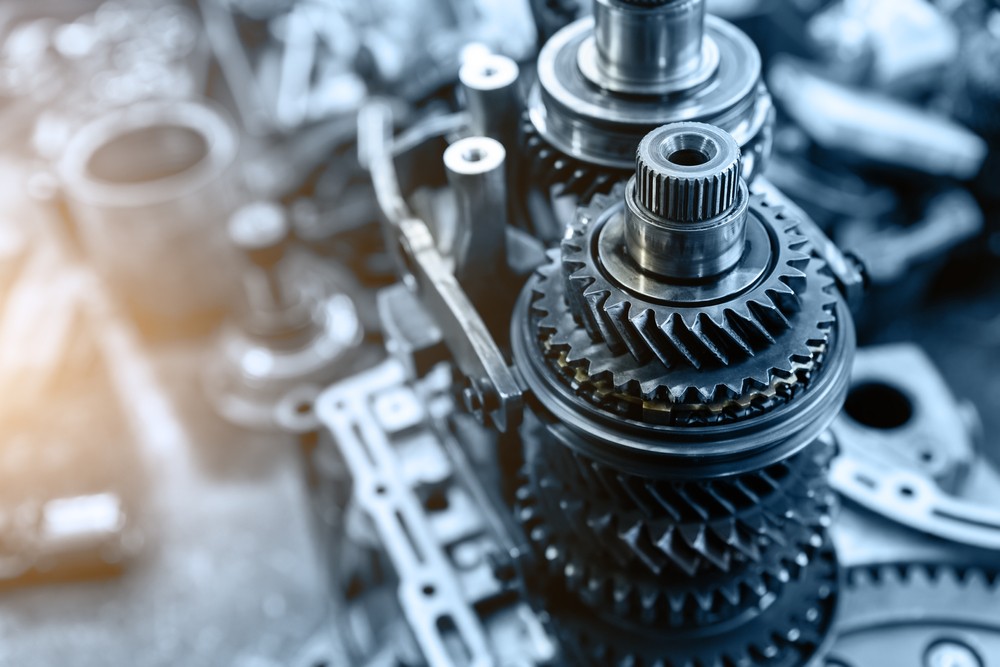

Auto Parts and Machinery

Auto Parts and Machinery

Auto Parts and Machinery

Pharmaceutical & Medical Equipments

Pharmaceutical & Medical Equipments

Pharmaceutical & Medical Equipments

FAQs

All details about the item and its function can be found here.

Can't locate the solution you desire? Reach out to our crew!

What is a Free Trade Zone in India ?

Free Trade Zone in India, a Special Category of Special Economic Zone, can be a 'stand-alone or a demarcated area within a sector-specific or multiproduct specific SEZ. Free Trade Zone in India is a deemed Foreign Territory with special status and benefits. It is a dedicated platform for warehousing and trading, governed by SEZ act 2005 & Rules 2006.

How businesses benefit from Free Trade Zone ?

A Free Trade Zone offers several benefits for businesses, including tax exemptions, duty-free imports and exports, and simplified customs procedures. These incentives help reduce operational costs, improve profit margins, and enhance competitiveness in the global marketplace.

What activities are permitted inside the Free Trade Zone?

The activities that are allowed inside a free trade zone include and storage of goods (of domestic or foreign clients), re-exporting your commodity duty-free, trading with/without labeling, packing, quality checking, lashing, strapping, shrink wrapping, consolidation, clubbing, bottling, palletization, kitting, testing, combination packing, assembling of semi-knockdown and finished goods and other operations.

Can the goods be kept forever inside the Free Trade Zone without paying taxes and customs duty?

Goods can be warehoused inside the free trade warehousing zone for 3 years which is extendable up to 5 years in special permissions. Post that the cargo is either auctioned or can be cleared/re-exported by paying custom duties.

How long does customs clearance take via Free Trade Zone?

Typically, customs clearance for imported goods through a free trade zone or free trade warehousing zone is completed within 24 to 48 hours.

What types of industries commonly utilize Free Trade Zone for trading and business purposes?

Free Trade Zone are utilized by a diverse range of industries, including pharmaceuticals, luxury goods, chemicals, medical devices, liquor, auto parts, aviation, electronics, IT (servers), food, electrical appliances, polymers, pulses, edible oil, sugar, fruits, dry fruits, industrial machinery, and electric machinery and equipment.

Still got questions?

If you don't find an answer to your question, contact us, and our team will get in touch with you.

FAQs

All details about the item and its function can be found here.

Can't locate the solution you desire? Reach out to our crew!

What is a Free Trade Zone in India ?

Free Trade Zone in India, a Special Category of Special Economic Zone, can be a 'stand-alone or a demarcated area within a sector-specific or multiproduct specific SEZ. Free Trade Zone in India is a deemed Foreign Territory with special status and benefits. It is a dedicated platform for warehousing and trading, governed by SEZ act 2005 & Rules 2006.

How businesses benefit from Free Trade Zone ?

A Free Trade Zone offers several benefits for businesses, including tax exemptions, duty-free imports and exports, and simplified customs procedures. These incentives help reduce operational costs, improve profit margins, and enhance competitiveness in the global marketplace.

What activities are permitted inside the Free Trade Zone?

The activities that are allowed inside a free trade zone include and storage of goods (of domestic or foreign clients), re-exporting your commodity duty-free, trading with/without labeling, packing, quality checking, lashing, strapping, shrink wrapping, consolidation, clubbing, bottling, palletization, kitting, testing, combination packing, assembling of semi-knockdown and finished goods and other operations.

Can the goods be kept forever inside the Free Trade Zone without paying taxes and customs duty?

Goods can be warehoused inside the free trade warehousing zone for 3 years which is extendable up to 5 years in special permissions. Post that the cargo is either auctioned or can be cleared/re-exported by paying custom duties.

How long does customs clearance take via Free Trade Zone?

Typically, customs clearance for imported goods through a free trade zone or free trade warehousing zone is completed within 24 to 48 hours.

What types of industries commonly utilize Free Trade Zone for trading and business purposes?

Free Trade Zone are utilized by a diverse range of industries, including pharmaceuticals, luxury goods, chemicals, medical devices, liquor, auto parts, aviation, electronics, IT (servers), food, electrical appliances, polymers, pulses, edible oil, sugar, fruits, dry fruits, industrial machinery, and electric machinery and equipment.

Still got questions?

If you don't find an answer to your question, contact us, and our team will get in touch with you.

FAQs

All details about the item and its function can be found here.

Can't locate the solution you desire? Reach out to our crew!

What is a Free Trade Zone in India ?

Free Trade Zone in India, a Special Category of Special Economic Zone, can be a 'stand-alone or a demarcated area within a sector-specific or multiproduct specific SEZ. Free Trade Zone in India is a deemed Foreign Territory with special status and benefits. It is a dedicated platform for warehousing and trading, governed by SEZ act 2005 & Rules 2006.

How businesses benefit from Free Trade Zone ?

A Free Trade Zone offers several benefits for businesses, including tax exemptions, duty-free imports and exports, and simplified customs procedures. These incentives help reduce operational costs, improve profit margins, and enhance competitiveness in the global marketplace.

What activities are permitted inside the Free Trade Zone?

The activities that are allowed inside a free trade zone include and storage of goods (of domestic or foreign clients), re-exporting your commodity duty-free, trading with/without labeling, packing, quality checking, lashing, strapping, shrink wrapping, consolidation, clubbing, bottling, palletization, kitting, testing, combination packing, assembling of semi-knockdown and finished goods and other operations.

Can the goods be kept forever inside the Free Trade Zone without paying taxes and customs duty?

Goods can be warehoused inside the free trade warehousing zone for 3 years which is extendable up to 5 years in special permissions. Post that the cargo is either auctioned or can be cleared/re-exported by paying custom duties.

How long does customs clearance take via Free Trade Zone?

Typically, customs clearance for imported goods through a free trade zone or free trade warehousing zone is completed within 24 to 48 hours.

What types of industries commonly utilize Free Trade Zone for trading and business purposes?

Free Trade Zone are utilized by a diverse range of industries, including pharmaceuticals, luxury goods, chemicals, medical devices, liquor, auto parts, aviation, electronics, IT (servers), food, electrical appliances, polymers, pulses, edible oil, sugar, fruits, dry fruits, industrial machinery, and electric machinery and equipment.

Still got questions?

If you don't find an answer to your question, contact us, and our team will get in touch with you.

SEamless innovation unmatched reliability

Copyright © 2024 .All Rights Reserved