Understanding the Difference Between SEZ and FTWZ

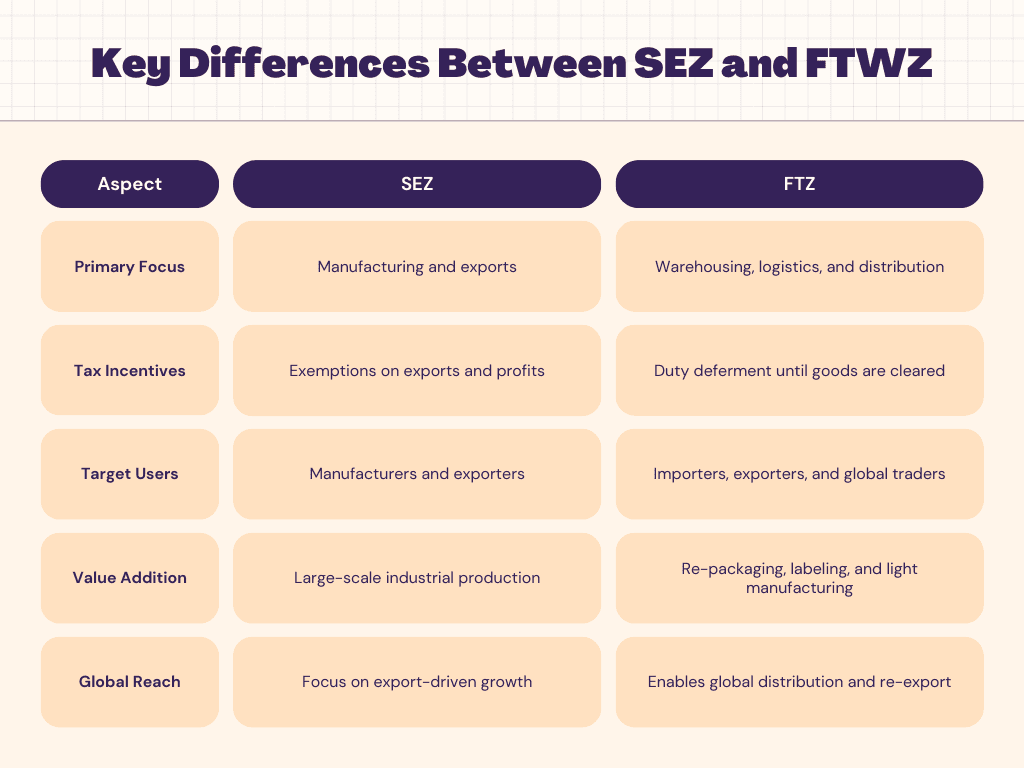

India’s trade ecosystem is driven by various specialized zones designed to boost economic growth and facilitate international trade. Among these, Special Economic Zones (SEZs) and Free Trade Warehousing Zones (FTWZs) stand out as powerful tools for businesses. While they share a common goal of promoting trade and investment, their focus and functionalities differ significantly. This blog will explore the key differences between SEZs and FTWZs and their unique advantages.

What is a Special Economic Zone (SEZ)?

Special Economic Zones (SEZs) are designated areas aimed at promoting industrial growth, manufacturing, and exports. These zones offer a range of fiscal and operational benefits to attract investments and foster large-scale production.

Key Features of SEZs:

Manufacturing and Export-Oriented: SEZs are designed to boost exports through large-scale manufacturing and production facilities.

Tax Incentives: Businesses in SEZs enjoy exemptions from customs duties, excise, and income tax for a specified period.

Infrastructure Support: SEZs provide state-of-the-art infrastructure, including power, water, and connectivity, to facilitate operations.

Employment Opportunities: These zones generate significant employment, particularly in manufacturing and allied sectors.

Sector-Specific Focus: SEZs often focus on specific industries such as IT, pharmaceuticals, textiles, and electronics.

What is a Free Trade Warehousing Zone (FTWZ)?

Free Trade Warehousing Zones (FTWZs) are specialized zones designed to facilitate efficient warehousing, logistics, and distribution of goods for both import and export purposes. They primarily cater to businesses involved in global trade and inventory management.

Key Features of FTWZs:

Focus on Warehousing and Distribution: FTWZs specialize in storage, re-packaging, labeling, and distribution of goods.

Duty Deferral and Exemptions: Import duties are deferred until goods are cleared for domestic use, helping businesses optimize cash flow.

International Trade Facilitation: Free trade zone in India provide a platform for global businesses to store, consolidate, and re-export goods without incurring Indian duties or taxes.

Minimal Regulatory Requirements: Foreign companies can operate in FTWZs without permanent establishment or tax liabilities in India.

Value-Added Services: FTWZs offer additional services such as kitting, assembly, and transformation of goods to meet global trade requirements.

Choosing the Right Zone for Your Business

The choice between SEZs and FTWZs depends on your business requirements:

If your focus is on large-scale manufacturing and exports, an SEZ offers the infrastructure and tax incentives to enhance your operations.

If you are involved in global trade, import-export, or inventory management, an FTWZ is the ideal solution for cost-effective warehousing and distribution.

Leveraging Free Trade Zones for Business Growth

Free Trade Zones (FTZs), encompassing both SEZs and FTWZs, serve as more than just tax-saving hubs; they are dynamic trade and logistics centers that enable businesses to thrive in global markets. While SEZs cater to manufacturing and export-oriented industries, FTWZs specialize in warehousing, distribution, and logistics, making them invaluable for companies pursuing global expansion.

By leveraging the unique advantages of SEZs and FTWZs, businesses can strategically enhance their operations, streamline supply chains, and seize growth opportunities in international trade.

Astromar: Your Trusted Partner for FTWZ Solutions

Astromar’s Free Trade Warehousing Zone in Chennai is designed to empower businesses with advanced warehousing solutions, seamless customs clearance, and value-added services. Strategically located near ports and airports, Astromar FTWZ ensures smooth access to global markets, helping businesses achieve sustainable growth.

📞 Contact us at:

+91 9940211014

Email: sales@astromarfreezone.com

Website: www.astromarfreezone.com

Understanding the Difference Between SEZ and FTWZ

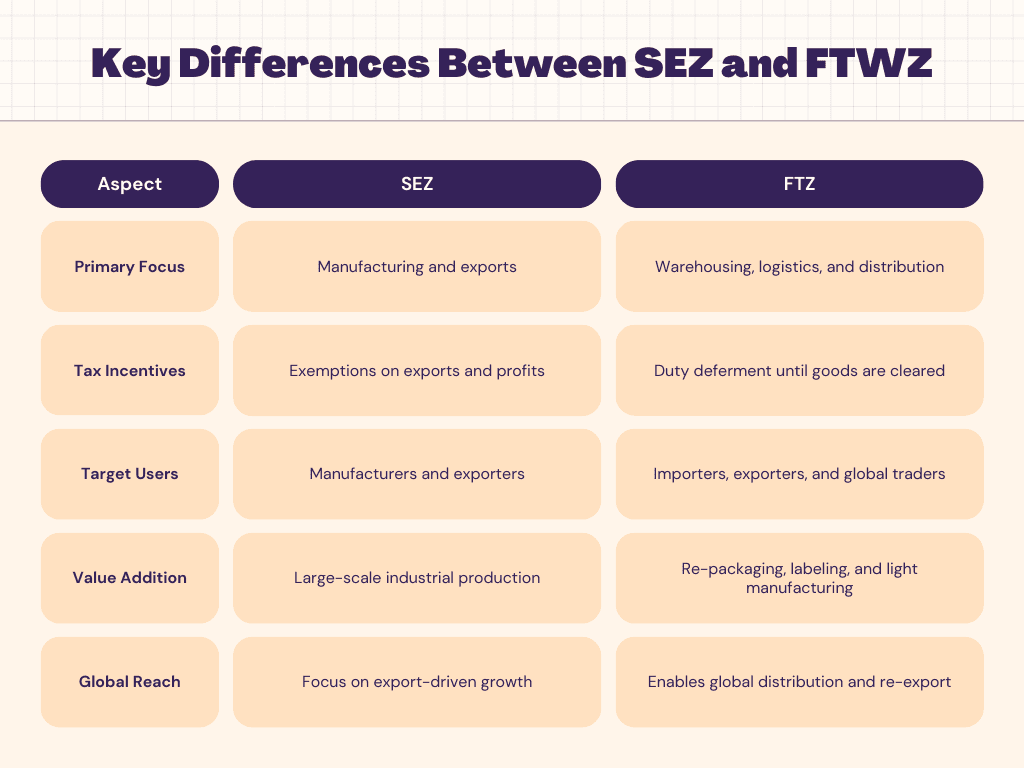

India’s trade ecosystem is driven by various specialized zones designed to boost economic growth and facilitate international trade. Among these, Special Economic Zones (SEZs) and Free Trade Warehousing Zones (FTWZs) stand out as powerful tools for businesses. While they share a common goal of promoting trade and investment, their focus and functionalities differ significantly. This blog will explore the key differences between SEZs and FTWZs and their unique advantages.

What is a Special Economic Zone (SEZ)?

Special Economic Zones (SEZs) are designated areas aimed at promoting industrial growth, manufacturing, and exports. These zones offer a range of fiscal and operational benefits to attract investments and foster large-scale production.

Key Features of SEZs:

Manufacturing and Export-Oriented: SEZs are designed to boost exports through large-scale manufacturing and production facilities.

Tax Incentives: Businesses in SEZs enjoy exemptions from customs duties, excise, and income tax for a specified period.

Infrastructure Support: SEZs provide state-of-the-art infrastructure, including power, water, and connectivity, to facilitate operations.

Employment Opportunities: These zones generate significant employment, particularly in manufacturing and allied sectors.

Sector-Specific Focus: SEZs often focus on specific industries such as IT, pharmaceuticals, textiles, and electronics.

What is a Free Trade Warehousing Zone (FTWZ)?

Free Trade Warehousing Zones (FTWZs) are specialized zones designed to facilitate efficient warehousing, logistics, and distribution of goods for both import and export purposes. They primarily cater to businesses involved in global trade and inventory management.

Key Features of FTWZs:

Focus on Warehousing and Distribution: FTWZs specialize in storage, re-packaging, labeling, and distribution of goods.

Duty Deferral and Exemptions: Import duties are deferred until goods are cleared for domestic use, helping businesses optimize cash flow.

International Trade Facilitation: Free trade zone in India provide a platform for global businesses to store, consolidate, and re-export goods without incurring Indian duties or taxes.

Minimal Regulatory Requirements: Foreign companies can operate in FTWZs without permanent establishment or tax liabilities in India.

Value-Added Services: FTWZs offer additional services such as kitting, assembly, and transformation of goods to meet global trade requirements.

Choosing the Right Zone for Your Business

The choice between SEZs and FTWZs depends on your business requirements:

If your focus is on large-scale manufacturing and exports, an SEZ offers the infrastructure and tax incentives to enhance your operations.

If you are involved in global trade, import-export, or inventory management, an FTWZ is the ideal solution for cost-effective warehousing and distribution.

Leveraging Free Trade Zones for Business Growth

Free Trade Zones (FTZs), encompassing both SEZs and FTWZs, serve as more than just tax-saving hubs; they are dynamic trade and logistics centers that enable businesses to thrive in global markets. While SEZs cater to manufacturing and export-oriented industries, FTWZs specialize in warehousing, distribution, and logistics, making them invaluable for companies pursuing global expansion.

By leveraging the unique advantages of SEZs and FTWZs, businesses can strategically enhance their operations, streamline supply chains, and seize growth opportunities in international trade.

Astromar: Your Trusted Partner for FTWZ Solutions

Astromar’s Free Trade Warehousing Zone in Chennai is designed to empower businesses with advanced warehousing solutions, seamless customs clearance, and value-added services. Strategically located near ports and airports, Astromar FTWZ ensures smooth access to global markets, helping businesses achieve sustainable growth.

📞 Contact us at:

+91 9940211014

Email: sales@astromarfreezone.com

Website: www.astromarfreezone.com

Understanding the Difference Between SEZ and FTWZ

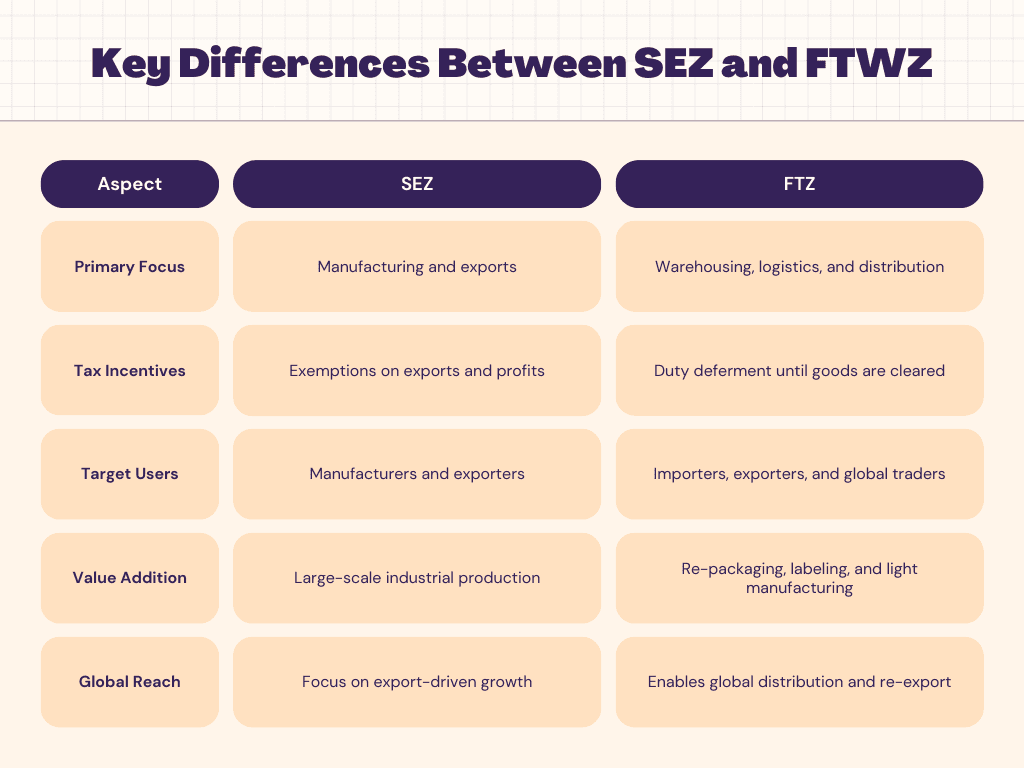

India’s trade ecosystem is driven by various specialized zones designed to boost economic growth and facilitate international trade. Among these, Special Economic Zones (SEZs) and Free Trade Warehousing Zones (FTWZs) stand out as powerful tools for businesses. While they share a common goal of promoting trade and investment, their focus and functionalities differ significantly. This blog will explore the key differences between SEZs and FTWZs and their unique advantages.

What is a Special Economic Zone (SEZ)?

Special Economic Zones (SEZs) are designated areas aimed at promoting industrial growth, manufacturing, and exports. These zones offer a range of fiscal and operational benefits to attract investments and foster large-scale production.

Key Features of SEZs:

Manufacturing and Export-Oriented: SEZs are designed to boost exports through large-scale manufacturing and production facilities.

Tax Incentives: Businesses in SEZs enjoy exemptions from customs duties, excise, and income tax for a specified period.

Infrastructure Support: SEZs provide state-of-the-art infrastructure, including power, water, and connectivity, to facilitate operations.

Employment Opportunities: These zones generate significant employment, particularly in manufacturing and allied sectors.

Sector-Specific Focus: SEZs often focus on specific industries such as IT, pharmaceuticals, textiles, and electronics.

What is a Free Trade Warehousing Zone (FTWZ)?

Free Trade Warehousing Zones (FTWZs) are specialized zones designed to facilitate efficient warehousing, logistics, and distribution of goods for both import and export purposes. They primarily cater to businesses involved in global trade and inventory management.

Key Features of FTWZs:

Focus on Warehousing and Distribution: FTWZs specialize in storage, re-packaging, labeling, and distribution of goods.

Duty Deferral and Exemptions: Import duties are deferred until goods are cleared for domestic use, helping businesses optimize cash flow.

International Trade Facilitation: Free trade zone in India provide a platform for global businesses to store, consolidate, and re-export goods without incurring Indian duties or taxes.

Minimal Regulatory Requirements: Foreign companies can operate in FTWZs without permanent establishment or tax liabilities in India.

Value-Added Services: FTWZs offer additional services such as kitting, assembly, and transformation of goods to meet global trade requirements.

Choosing the Right Zone for Your Business

The choice between SEZs and FTWZs depends on your business requirements:

If your focus is on large-scale manufacturing and exports, an SEZ offers the infrastructure and tax incentives to enhance your operations.

If you are involved in global trade, import-export, or inventory management, an FTWZ is the ideal solution for cost-effective warehousing and distribution.

Leveraging Free Trade Zones for Business Growth

Free Trade Zones (FTZs), encompassing both SEZs and FTWZs, serve as more than just tax-saving hubs; they are dynamic trade and logistics centers that enable businesses to thrive in global markets. While SEZs cater to manufacturing and export-oriented industries, FTWZs specialize in warehousing, distribution, and logistics, making them invaluable for companies pursuing global expansion.

By leveraging the unique advantages of SEZs and FTWZs, businesses can strategically enhance their operations, streamline supply chains, and seize growth opportunities in international trade.

Astromar: Your Trusted Partner for FTWZ Solutions

Astromar’s Free Trade Warehousing Zone in Chennai is designed to empower businesses with advanced warehousing solutions, seamless customs clearance, and value-added services. Strategically located near ports and airports, Astromar FTWZ ensures smooth access to global markets, helping businesses achieve sustainable growth.

📞 Contact us at:

+91 9940211014

Email: sales@astromarfreezone.com

Website: www.astromarfreezone.com