What is a Free Trade Zone India?

A Free Trade Zone (FTZ) is a specially designated area within a country where goods can be imported, stored, handled, manufactured, or re-exported without being subject to the usual customs duties and taxes. These zones are established to promote trade by simplifying customs procedures, offering tax incentives, and fostering economic growth. Businesses operating within FTZs benefit from reduced costs, streamlined logistics, and enhanced global trade opportunities.

Definition of a Free Trade Zone

A Free Trade Zone is a secured area located near seaports, airports, or international trade hubs. These zones allow businesses to operate with relaxed regulatory requirements and tax advantages to facilitate trade and attract investment. FTZs serve as vital links in the global supply chain, supporting activities like warehousing, processing, and re-exporting goods.

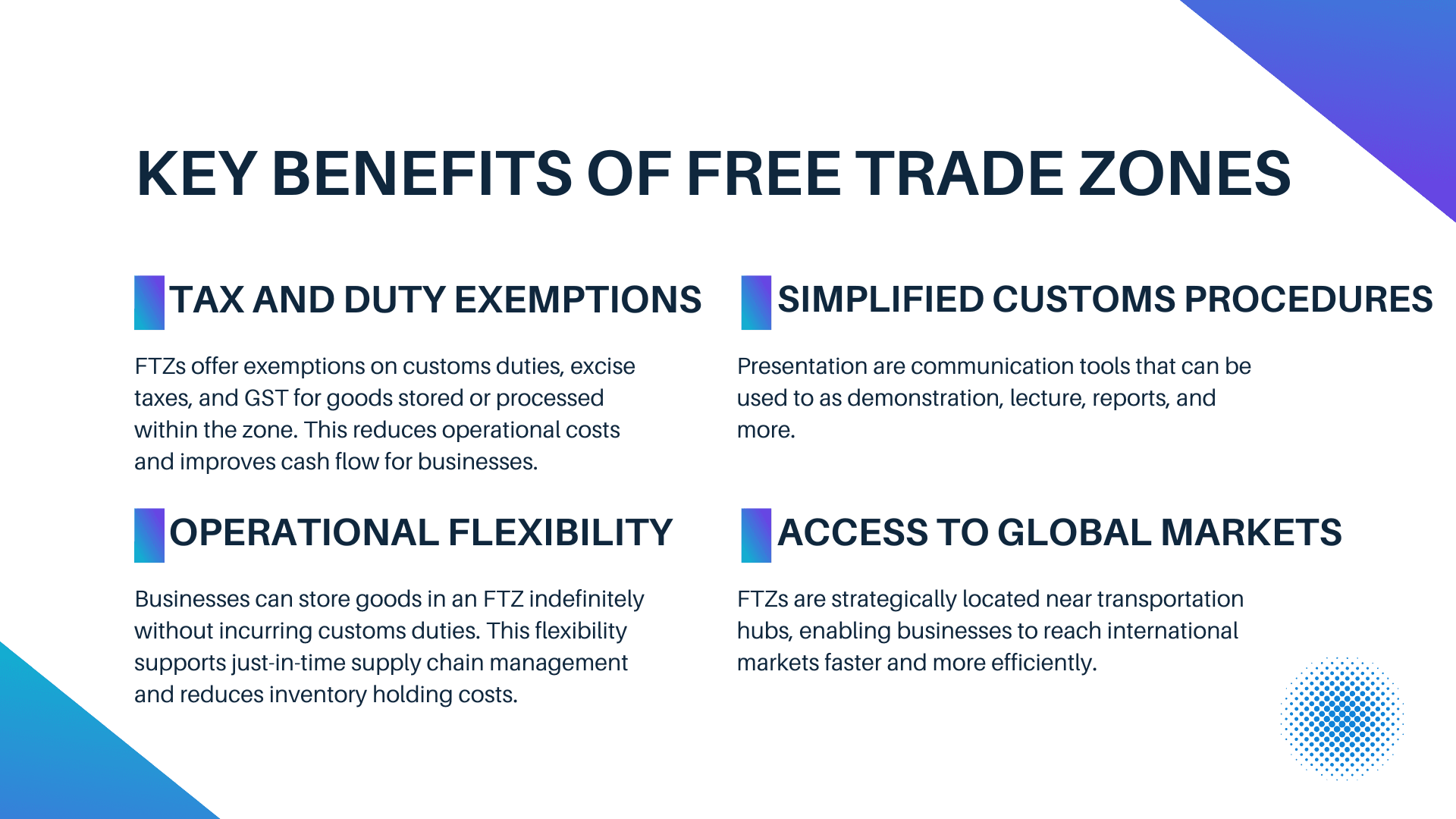

Key Benefits of Free Trade Zones

Tax and Duty Exemptions

FTZs offer exemptions on customs duties, excise taxes, and GST for goods stored or processed within the zone. This reduces operational costs and improves cash flow for businesses.

Simplified Customs Procedures

Goods entering and leaving FTZs face minimal regulatory hurdles. Customs processes are streamlined, allowing for faster clearance and reduced paperwork.

Cost-Effective Warehousing and Logistics

FTZs provide state-of-the-art warehousing and logistics infrastructure at competitive rates. This includes inventory management, packaging, and re-exporting solutions.

Operational Flexibility

Businesses can store goods in an FTZ indefinitely without incurring customs duties. This flexibility supports just-in-time supply chain management and reduces inventory holding costs.

Access to Global Markets

FTZs are strategically located near transportation hubs, enabling businesses to reach international markets faster and more efficiently.

Improved Competitiveness

Reduced costs and efficient operations make businesses in FTZs more competitive in global trade, attracting customers and investors alike.

How Free Trade Zones Drive Economic Growth

Free Trade Zone not only benefit individual businesses but also contribute to national economies by:

Attracting foreign investment.

Creating jobs in logistics, manufacturing, and trade.

Enhancing export potential and reducing trade deficits.

Astromar Free Trade Zone: Your Gateway to Global Trade

Astromar Free Trade Zone in India is a premier facility designed to help businesses thrive in the global market. Offering cutting-edge infrastructure, tax benefits, and seamless logistics solutions, Astromar FTZ enables businesses to maximize efficiency and profitability. Whether you’re looking to expand operations or optimize your supply chain, Astromar FTZ is your trusted partner for success.

What is a Free Trade Zone India?

A Free Trade Zone (FTZ) is a specially designated area within a country where goods can be imported, stored, handled, manufactured, or re-exported without being subject to the usual customs duties and taxes. These zones are established to promote trade by simplifying customs procedures, offering tax incentives, and fostering economic growth. Businesses operating within FTZs benefit from reduced costs, streamlined logistics, and enhanced global trade opportunities.

Definition of a Free Trade Zone

A Free Trade Zone is a secured area located near seaports, airports, or international trade hubs. These zones allow businesses to operate with relaxed regulatory requirements and tax advantages to facilitate trade and attract investment. FTZs serve as vital links in the global supply chain, supporting activities like warehousing, processing, and re-exporting goods.

Key Benefits of Free Trade Zones

Tax and Duty Exemptions

FTZs offer exemptions on customs duties, excise taxes, and GST for goods stored or processed within the zone. This reduces operational costs and improves cash flow for businesses.

Simplified Customs Procedures

Goods entering and leaving FTZs face minimal regulatory hurdles. Customs processes are streamlined, allowing for faster clearance and reduced paperwork.

Cost-Effective Warehousing and Logistics

FTZs provide state-of-the-art warehousing and logistics infrastructure at competitive rates. This includes inventory management, packaging, and re-exporting solutions.

Operational Flexibility

Businesses can store goods in an FTZ indefinitely without incurring customs duties. This flexibility supports just-in-time supply chain management and reduces inventory holding costs.

Access to Global Markets

FTZs are strategically located near transportation hubs, enabling businesses to reach international markets faster and more efficiently.

Improved Competitiveness

Reduced costs and efficient operations make businesses in FTZs more competitive in global trade, attracting customers and investors alike.

How Free Trade Zones Drive Economic Growth

Free Trade Zone not only benefit individual businesses but also contribute to national economies by:

Attracting foreign investment.

Creating jobs in logistics, manufacturing, and trade.

Enhancing export potential and reducing trade deficits.

Astromar Free Trade Zone: Your Gateway to Global Trade

Astromar Free Trade Zone in India is a premier facility designed to help businesses thrive in the global market. Offering cutting-edge infrastructure, tax benefits, and seamless logistics solutions, Astromar FTZ enables businesses to maximize efficiency and profitability. Whether you’re looking to expand operations or optimize your supply chain, Astromar FTZ is your trusted partner for success.

What is a Free Trade Zone India?

A Free Trade Zone (FTZ) is a specially designated area within a country where goods can be imported, stored, handled, manufactured, or re-exported without being subject to the usual customs duties and taxes. These zones are established to promote trade by simplifying customs procedures, offering tax incentives, and fostering economic growth. Businesses operating within FTZs benefit from reduced costs, streamlined logistics, and enhanced global trade opportunities.

Definition of a Free Trade Zone

A Free Trade Zone is a secured area located near seaports, airports, or international trade hubs. These zones allow businesses to operate with relaxed regulatory requirements and tax advantages to facilitate trade and attract investment. FTZs serve as vital links in the global supply chain, supporting activities like warehousing, processing, and re-exporting goods.

Key Benefits of Free Trade Zones

Tax and Duty Exemptions

FTZs offer exemptions on customs duties, excise taxes, and GST for goods stored or processed within the zone. This reduces operational costs and improves cash flow for businesses.

Simplified Customs Procedures

Goods entering and leaving FTZs face minimal regulatory hurdles. Customs processes are streamlined, allowing for faster clearance and reduced paperwork.

Cost-Effective Warehousing and Logistics

FTZs provide state-of-the-art warehousing and logistics infrastructure at competitive rates. This includes inventory management, packaging, and re-exporting solutions.

Operational Flexibility

Businesses can store goods in an FTZ indefinitely without incurring customs duties. This flexibility supports just-in-time supply chain management and reduces inventory holding costs.

Access to Global Markets

FTZs are strategically located near transportation hubs, enabling businesses to reach international markets faster and more efficiently.

Improved Competitiveness

Reduced costs and efficient operations make businesses in FTZs more competitive in global trade, attracting customers and investors alike.

How Free Trade Zones Drive Economic Growth

Free Trade Zone not only benefit individual businesses but also contribute to national economies by:

Attracting foreign investment.

Creating jobs in logistics, manufacturing, and trade.

Enhancing export potential and reducing trade deficits.

Astromar Free Trade Zone: Your Gateway to Global Trade

Astromar Free Trade Zone in India is a premier facility designed to help businesses thrive in the global market. Offering cutting-edge infrastructure, tax benefits, and seamless logistics solutions, Astromar FTZ enables businesses to maximize efficiency and profitability. Whether you’re looking to expand operations or optimize your supply chain, Astromar FTZ is your trusted partner for success.